iowa capital gains tax on property

Capital Gains Tax Rates in Other States. Wisconsin taxes capital gains as income.

The Worst U S States To Retire In Ranked Finance 101 Gas Tax Healthcare Costs Better Healthcare

The property tax component accounts for 144 percent of each states.

. Todays map shows states rankings on the property tax component of our 2022 State Business Tax Climate IndexThe Indexs property tax component evaluates state and local taxes on real and personal property net worth and asset transfers. You can take a property out of trust before sale but its not necessary. The second tax to be aware of is the capital gains tax.

The first is the property tax. If you own the investment property for more than a year the long-term federal capital gains tax can be 0 15 or 20 depending on your income bracket. Nonresidents who earn or receive income from an Iowa source that is not subject to Iowa income tax withholding Beneficiaries of estates or trusts residents and nonresidents Taxpayers with income in addition to wages such as interest dividends capital gains rents royalties business income farm income or certain pensions.

Property taxes must be based on the market value of a. The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a married. For example if you bought a property in January 2021 and sold it in May 2021 which is less than 1 year you will have to pay short-term capital gains tax on any.

A gain or loss is based on the step-up in basis if applicable. The gain or loss of inherited property must be reported in the tax year in which it is sold. That tax is paid to the local Florida municipality.

Each city or town sets its own tax due dates its own tax rates and its own system of property assessment. All properties in Florida are assessed a taxable value and owners are responsible to pay annual property taxes based on that value. The 0 capital gains tax rete applies to the amount of capital gains that is taxed in the 15 or lower tax bracket.

Capital Gain Loss 5 Gross Income 2021 7 Other Gains Losses 5 Gross Income 2021 8. If You Sell Together. Of course being tax related your basis is not always simple to figure out.

Disposition of the property. A taxpayer would calculate all of their other ordinary income after deductions and if this amount is less than 72000 then the difference would be the. This is done to encourage investors to hold investments for a longer period of time.

Reporting Capital Gains and Losses Publication 103 Back to Table of Contents 3 1. Rhode Island Property Tax Rules. California has a flat corporate income tax rate of 8840 of gross income.

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable. The cut-off for a married couple in 2013 is about 72000 of taxable income. You may exclude up to 250000 in capital gains if single and up to.

A property becomes subject to capital gains tax if it has become more valuable than the price it was purchased for originally. This is a tax paid on the profits that you make on the sale of your Florida. As for the other states capital gains tax rates are as follows.

File a W-2 or 1099. Short-term capital gains on a property you have owned for less than a year are taxed like ordinary income at both the federal and state levels. For the 2020 tax year the short-term capital gains tax rate equals your ordinary income tax rate your tax bracket.

Wisconsin capital gains tax rates. However there are some state guidelines that every locality must follow. Long-term capital gains can apply a deduction of 30 or 60 for capital gains from the sale of farm assets.

INTRODUCTION Gains and losses from sales or other dispositions of capital assets are reportable for both Wisconsin and federal income tax purposes. Schedule D is where any capital gain or loss on the sale is reported. Long-Term Capital Gains Tax in Georgia.

Adopted and Filed Rules. Learn About Sales. The federal corporate income tax by contrast has a marginal bracketed corporate income taxCalifornias maximum marginal corporate income tax rate is the 9th highest in the United States ranking directly below Maines 8930.

If you and your spouse sell your house at the time youre getting divorced the capital gains tax applies. The sale goes on Schedule D and Form 8949 Sales and Other Dispositions of Capital Assets. However differences exist in the way Wisconsin and federal law treat such income and loss.

Use HomeGains Capital Gains Calculator to determine if your gain is tax free or how much capital gains tax is owed from the sale of a property. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. Improving Lives Through Smart Tax Policy.

The capital gains tax rate reaches 765. The IRS considers you the owner for tax purposes. Property taxes in Rhode Island are administered entirely at the local level.

Learn About Property Tax. Short-term capital gains tax rates are generally higher than long-term capital gains tax rates. But youre entitled to exclude a total of 500000 of gain from tax if you lived there for two of the five years before the sale.

The Wisconsin capital gains tax rate favors the seller better than the rates of Iowa Vermont New York Washington DC Minnesota Oregon New Jersey Hawaii and California.

Capital Gains Tax On Property Development Projects Developer Explains

State Corporate Income Tax Rates And Brackets Tax Foundation

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

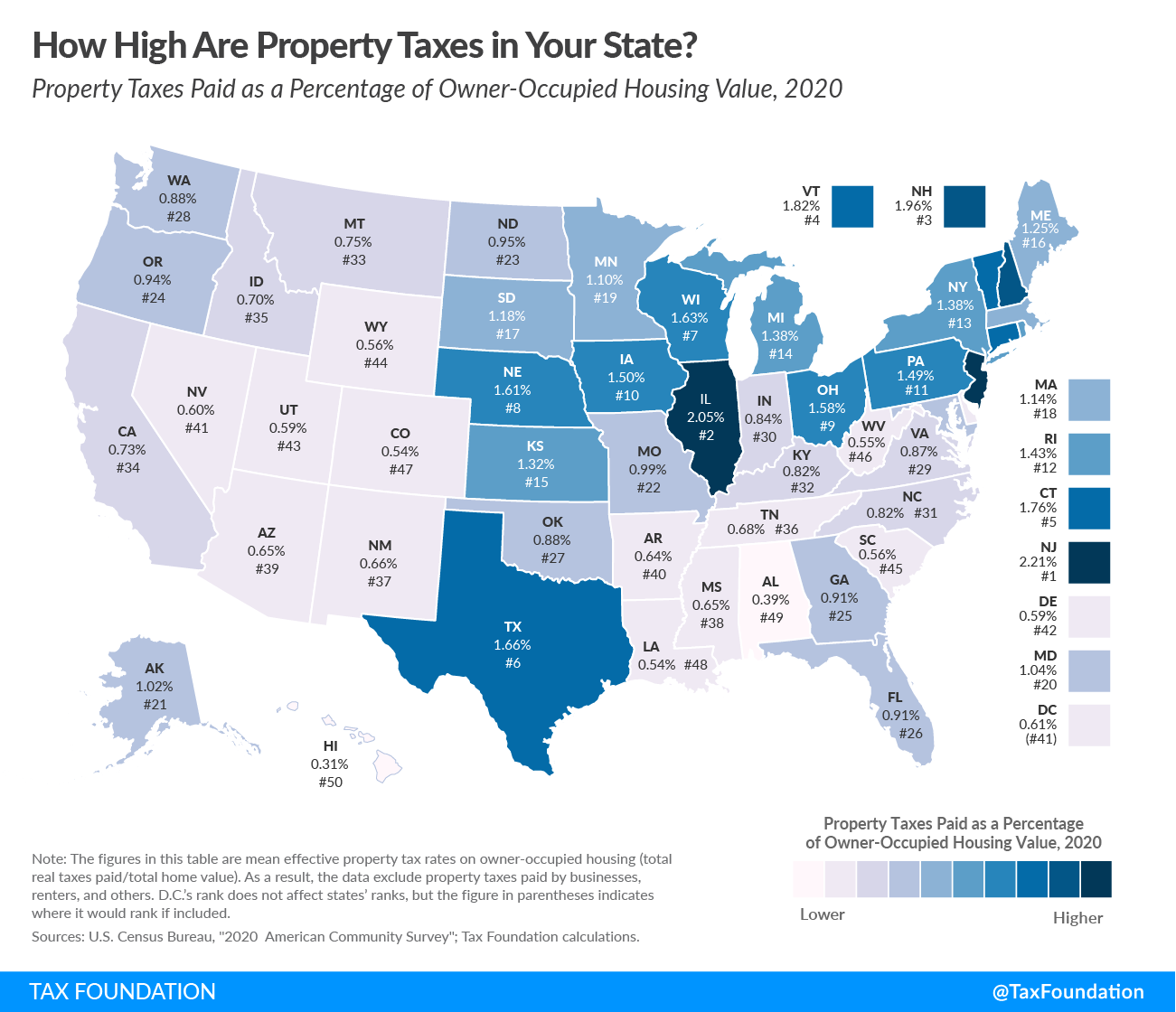

Property Taxes Property Tax Analysis Tax Foundation

State Taxes On Capital Gains Center On Budget And Policy Priorities

How Much Tax Will I Pay If I Flip A House New Silver

Florida Property Tax H R Block

I Like The Layout Of The Room With A Door In The Background That Opens To Another Space Repair And Maintenance Being A Landlord Repair

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Property Taxes Property Tax Analysis Tax Foundation

Know How Nris Can Reduce Tax Deducted At Source While Selling Property In India Mint

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Rental

Avoid Capital Gains Tax When Selling A House

Property Taxes Property Tax Analysis Tax Foundation

Capital Gains Tax Calculator 2022 Casaplorer

State Taxes On Capital Gains Center On Budget And Policy Priorities

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com